Skwad

Overview of Skwad

What is Skwad?

Skwad is a privacy-focused budgeting app designed to give you financial clarity without requiring access to your bank login details. It leverages your bank's built-in email alerts to track your spending and income automatically.

Key Features:

- Privacy-First Approach: No need to share your bank passwords or account numbers.

- Automated Transaction Tracking: Converts bank email alerts into categorized transactions.

- Instant Sync: Transactions are synced directly from your bank's alerts.

- Multiple Budgeting Options: Visualize your cash flow and spending categories.

- Customizable Expenses: Fully customizable categories to recategorize, split, or hide transactions.

- Bill Payment Reminders: Get alerts for upcoming bills and loan payments.

- Multiplayer Mode: Invite companions to share accounts and transactions for collaborative budgeting.

How to Use Skwad:

- Sign Up: Get a dedicated Skwad scan email address.

- Set Up Bank Alerts: Configure your bank or credit card provider to send automated spending & deposit alerts to your Skwad scan email address.

- Skwad Automates the Rest: Skwad converts these alerts into categorized transactions for you.

Why is Skwad Important?

Skwad addresses significant privacy concerns associated with traditional budgeting apps. By avoiding direct bank connections, it eliminates the risk of password leaks and unauthorized access to your financial data.

Where Can I Use Skwad?

Skwad is a web application accessible on any device with a browser. It is particularly useful for individuals concerned about sharing their bank credentials or those who prefer a more secure and private budgeting solution.

Best Way to Get Started with Skwad:

Start with the free trial to explore the features and see how Skwad can simplify your budgeting process. Set up your bank alerts and watch as Skwad automatically categorizes your transactions.

Customer Testimonials:

- Cecilia B. 🇨🇦: "Skwad is the only app that solves my problem. Other apps don't have support for my older bank, but I do get email alerts and Skwad parses them well."

- Derek Z. 🇺🇸: "I stopped using other apps because I was forced to re-sync my accounts EVERY SINGLE TIME I logged in. I've never had this issue with Skwad, and my transactions appear instantly."

Pricing

Skwad offers a free trial. They also offer paid plans with additional features. Check the website for current pricing details and any available discounts.

Best Alternative Tools to "Skwad"

An advanced AI-powered bank statement converter that helps you convert your PDF bank statements to a readable CSV or Excel format on your phone. Features include fast and accurate conversion, and a user-friendly interface.

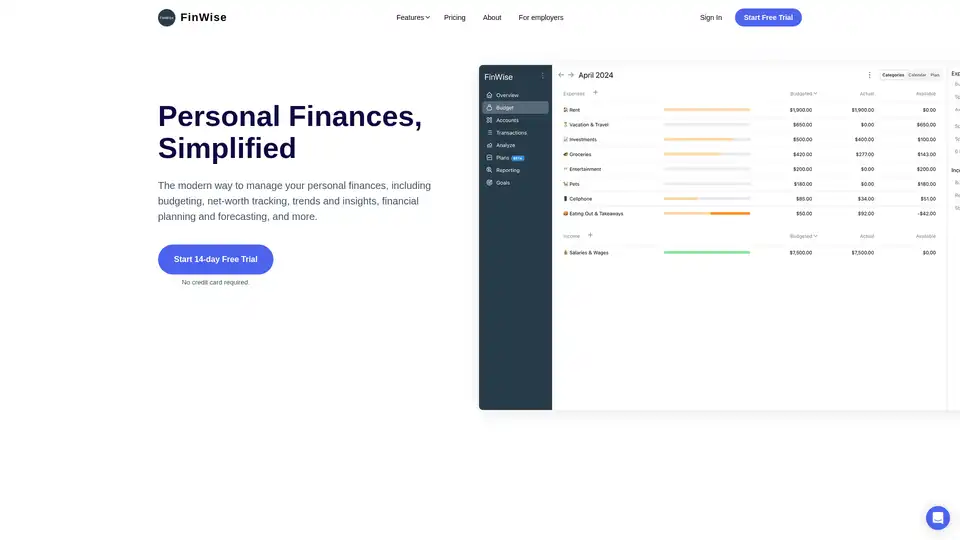

FinWise simplifies personal finance management with budgeting, net worth tracking, and financial planning tools. Securely connect accounts, track spending, and plan for the future.

SimplyBudget AI is a smart budgeting app that uses AI to simplify financial management. Track expenses, set goals, and manage loyalty cards effortlessly. Download today to achieve financial freedom!

Understand your spending and build better habits with AI. Peek auto-tracks your money, provides vibe checks, and helps set achievable goals for anxiety-free financial wellness.

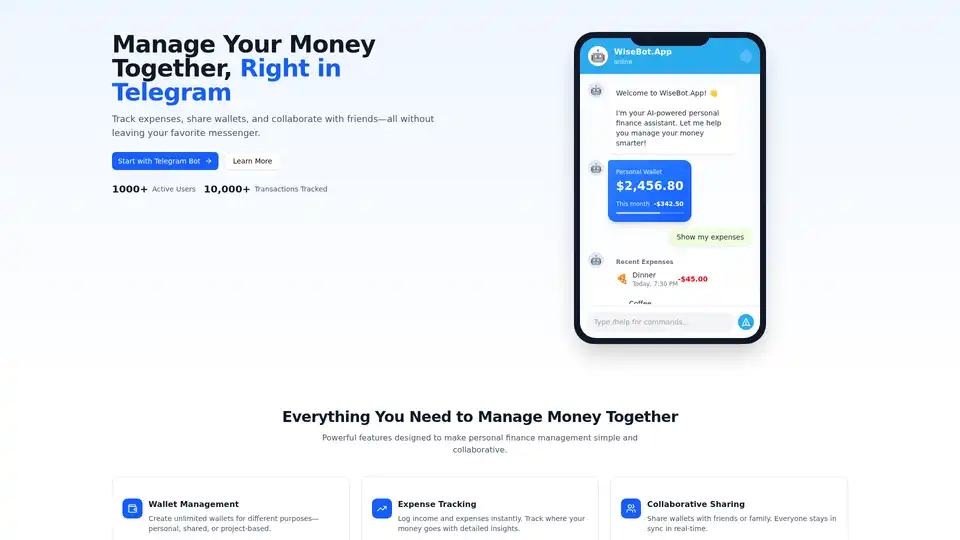

WiseBot.App is an AI-powered personal finance assistant in Telegram. Track expenses, manage wallets, share budgets collaboratively, and get smart AI insights—all securely without extra apps.

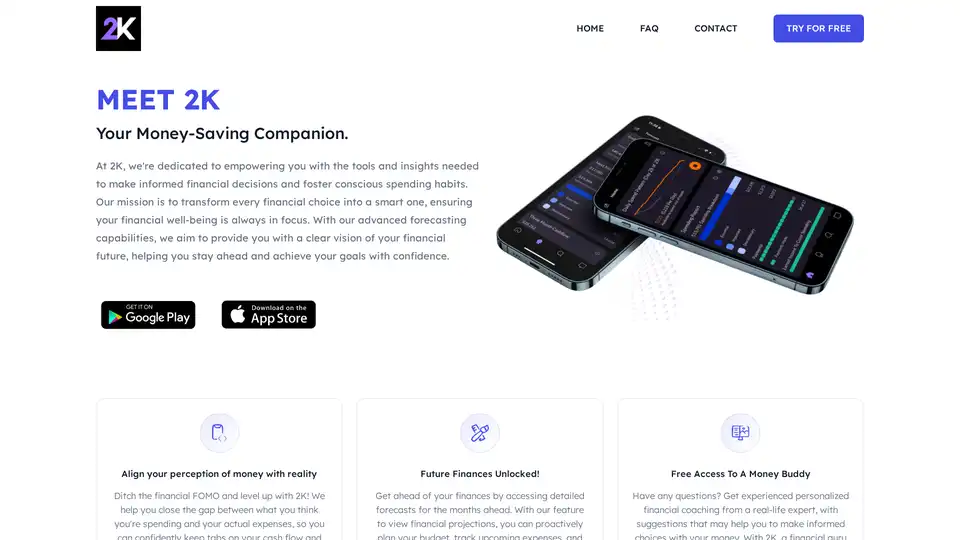

2K is an AI-powered personal finance app that tracks spending, forecasts budgets, and offers expert coaching to help you make smarter money decisions and maximize savings effortlessly.

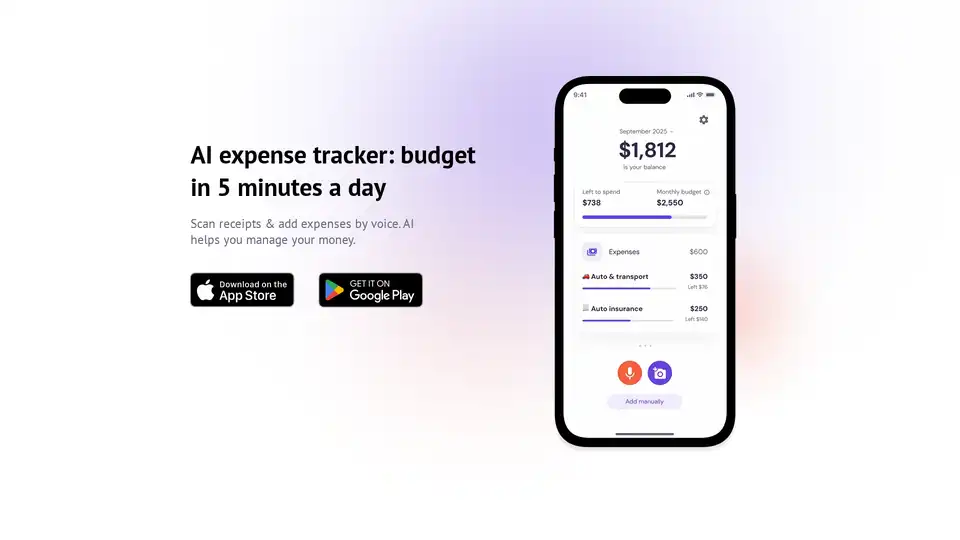

Vossa is an AI expense tracker app that simplifies budgeting with receipt scanning, voice input, and manual entry. Manage your money easily and stay on track with smart auto-categorization and clear stats.

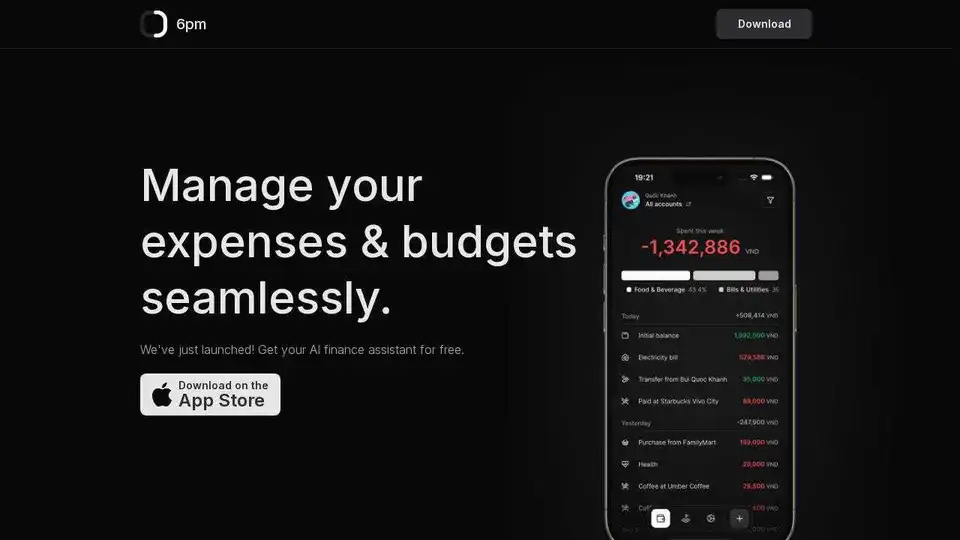

6pm is your AI financial assistant to manage expenses & budgets seamlessly. Track expenses, set goals, get insights for better financial decisions.

Transform your financial habits with ExpenseSorted. Smart expense tracking, AI-powered categorization, and insights to improve your financial health. Calculate your financial freedom using Google Sheets.

Best AI Excel Assistant with AI formulas to translate, extract, format & more. TwistlyCells integrates ChatGPT and Claude directly into Excel for seamless data handling and automation.

AppFlows is a free, privacy-first AI tool for founders and teams to quickly scope, estimate, and visualize mobile app ideas. Build strategies, wireframes, and growth plans with simple typing—no design skills needed.

Chatterlytics is an AI-powered data analytics and BI copilot providing secure insights, ad hoc reporting, and visualizations for smarter business decisions. Chat your way to instant answers!

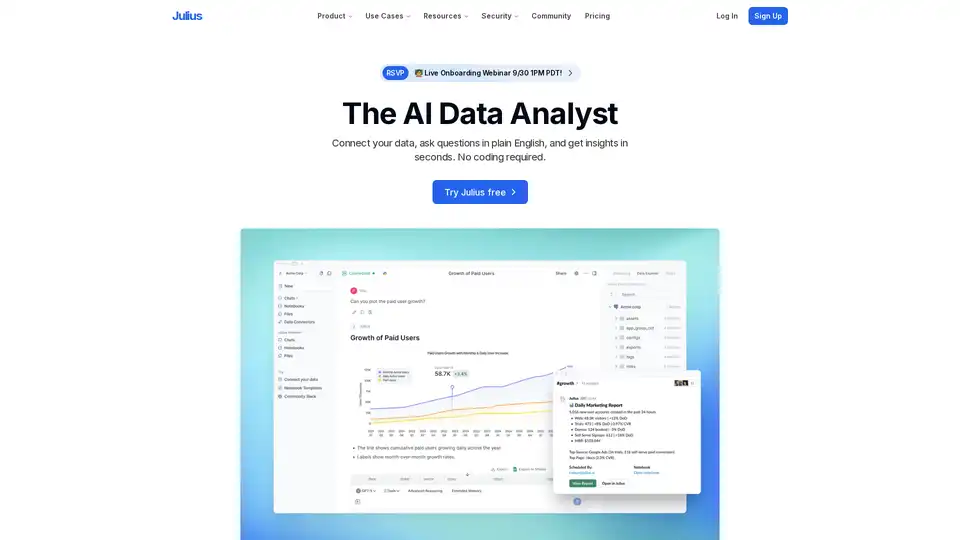

Julius AI is an AI data analyst that connects to your data, answers questions in plain English, and delivers instant insights. Automate reporting & visualize data effortlessly.

Dig in is an innovative AI-powered reward app that lets you track dining habits by authenticating food photos, set savings goals, and earn rewards like gift icons to cut down on eating-out costs effortlessly.