Pagaya

Overview of Pagaya

Pagaya: AI-Powered Lending Network

What is Pagaya?

Pagaya is an AI-driven lending network that enables financial institutions to expand access to more customers while managing risk effectively. Using machine learning and advanced data analytics, Pagaya's platform analyzes loan applications in real time, providing quick and accurate decisions.

How Pagaya Works:

- Integration: Integrate your origination system with Pagaya's network via API.

- AI-Powered Review: Pagaya's AI model analyzes applications in real time.

- Seamless Approvals: Customers receive approvals directly from your system.

Why is Pagaya important?

- Keep More Borrowers: Retain customers who don't meet your standard credit criteria.

- Grow Without Risk: Expand your credit offerings with zero balance sheet impact.

- Deepen Customer Relationships: Offer more loan products to increase engagement and loyalty.

Where can I use Pagaya?

Pagaya is suitable for:

- Point-of-sale lending

- Personal loans

- Auto loans

Partner Success:

"We know that we have many clients who don't fall within our traditional client parameters. By expanding access to responsible credit solutions, we are giving clients access to funds when they need it the most, through their existing and trusted banking relationship with us." -- Mike Shepard, Head of Consumer Lending Partnerships

Best way to expand your lending portfolio with AI-driven solutions. Visit Pagaya today!

Best Alternative Tools to "Pagaya"

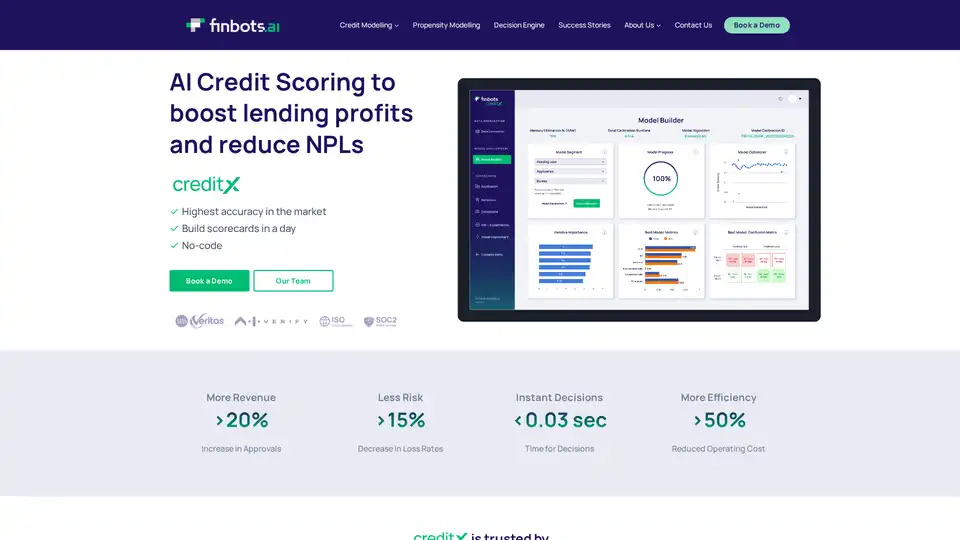

finbots.ai CreditX is an AI credit risk platform offering custom scorecards, rapid deployment, and smarter lending. It helps lenders increase approvals, reduce loss rates, and improve operational efficiency.

Casca is an AI-native Loan Origination System that automates 90% of manual efforts for FDIC-insured banks and lenders in business loan processing, boosting efficiency and conversions.

OmniAI uses AI agents to automate borrower onboarding, handling communication, document collection, and follow-ups. It accelerates loan processing and ensures compliance.

Clerkie is an AI-powered platform simplifying debt and money management. Optimize loan portfolios, automate payments, and ensure real-time compliance. Empower borrowers with flexible payment solutions.

Ocrolus is an intelligent document automation platform using AI to transform unstructured documents into actionable insights for faster, more accurate financial decisions. Automate document analysis to manage risk and prevent fraud.

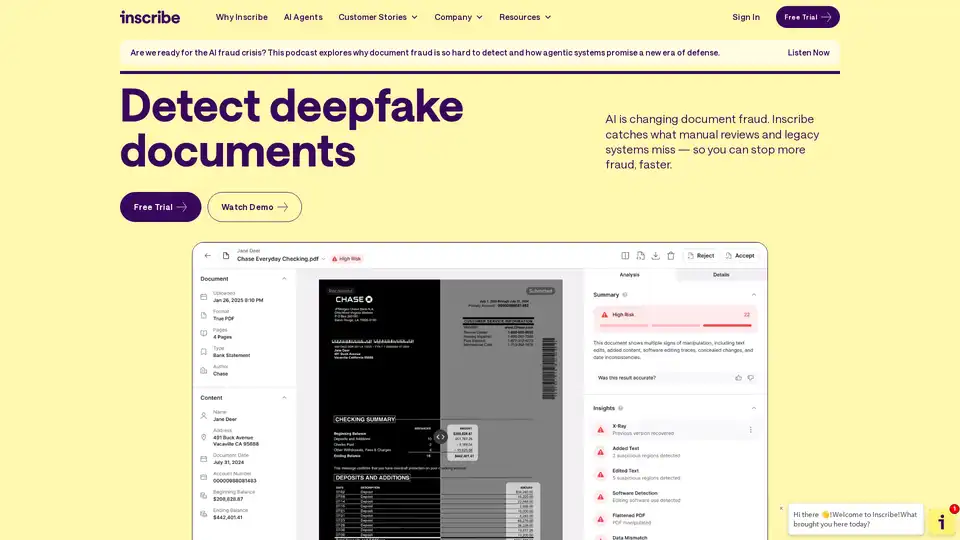

Inscribe detects advanced document fraud and other risks during onboarding and underwriting with AI Agents. Request a demo to learn more!

Celeste is an AI-powered platform for SMB loan payment collection, using intelligent technology to boost collection rates and reduce missed payments.

RevRag.AI provides AI agents for revenue teams, automating lead qualification, onboarding, and support. Designed for BFSI, Fintech, and Insurtech, it aims to boost conversions and improve customer engagement.

Twig AI is an advanced assistant for B2B customer support teams, featuring chatbots that reduce ticket handling and agent-assist tools that compile context-aware responses from data sheets and customer info for faster, efficient service.

Boost fintech revenue with inncivio, an AI-powered platform providing personalized, real-time in-app guidance to increase user engagement and transaction completion.

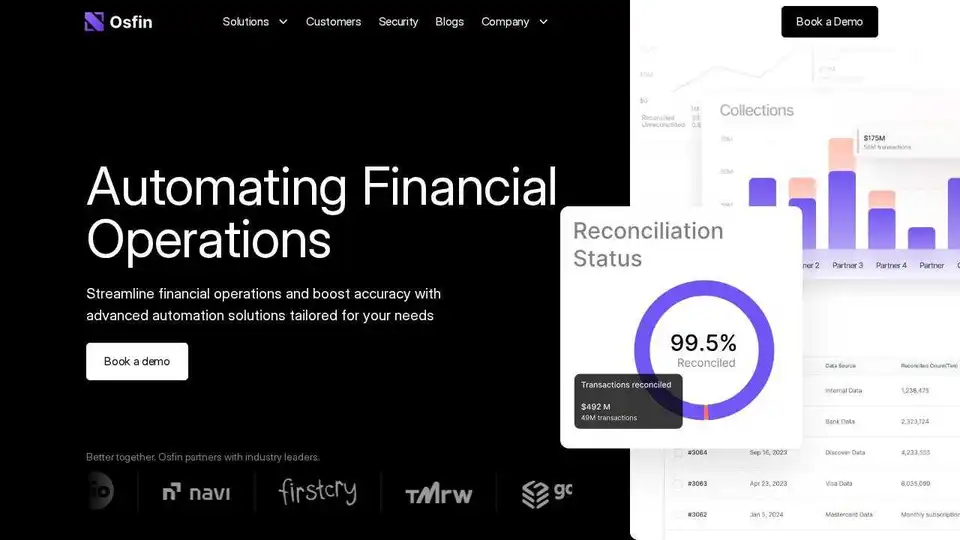

Osfin is an AI-powered platform automating financial operations & reconciliation. Streamline processes from reconciliation to payouts, boosting accuracy & efficiency for banking, fintech, and more.

PathPilot empowers fintechs, banks, and financial institutions to build secure AI agents in days—cutting costs, improving CX, and ensuring compliance. Launch AI agents 10x faster without compromising data security.

Maximize your stablecoin returns with Yield Seeker. Our AI-powered agent finds the safest, highest DeFi yields in real time. Simple, automated, and secure.

Kasisto's Agentic AI platform offers personalized banking experiences with KAIgentic AI. Predictive engagement and trusted compliance for financial institutions.